Busy few days for the P5

Monday morning we saw the Rover P5 leave us to head off for some gearbox work to be done. Prior to the car leaving our

Monday morning we saw the Rover P5 leave us to head off for some gearbox work to be done. Prior to the car leaving our

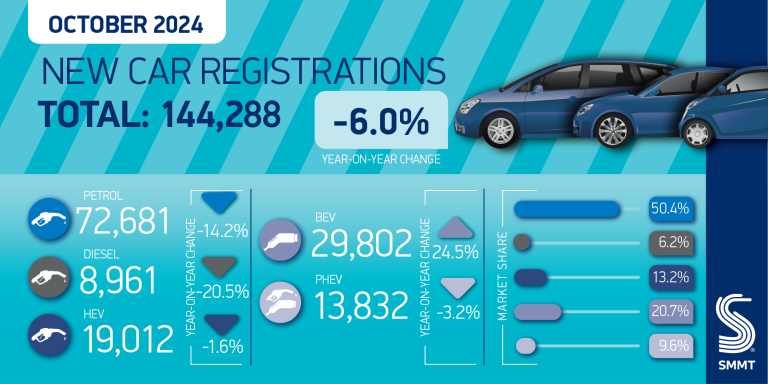

The UK new car market saw a decline of 6.0% in October, compared to last year, with only 144,288 new vehicle registrations, according to the

Monday morning we saw the Rover P5 leave us to head off for some gearbox work to be done. Prior to the car leaving our workshops we had a replacement door to prepare and fit.

Rather than spending many hours perfecting the existing door and replacing all of the corrosion with new metal, we were supplied with new/old stock replacement doors.

These still needed to be prepared, painted and fitted. But of-course, it is never as easy as it sounds. The door didn’t fit properly so more work was required than we expected but we got there in time for collection on Monday.

Here is Mauro flattening and polishing the paintwork.

And away she goes…

The driver arrived on time, bright and early so the car leaves us now for a little while.

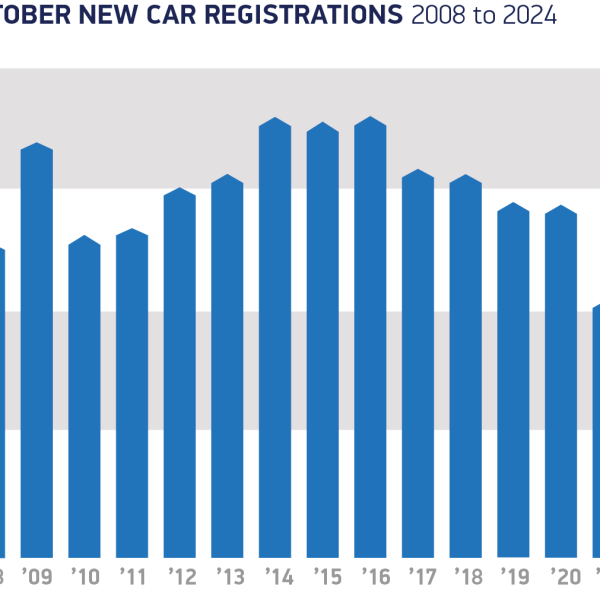

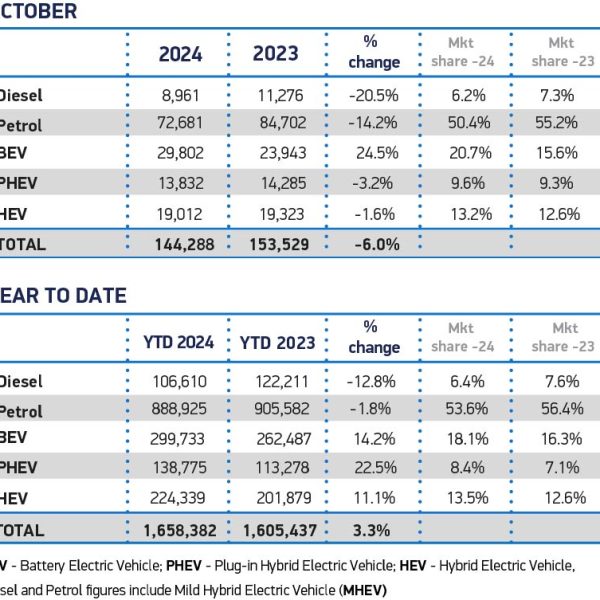

The UK new car market saw a decline of 6.0% in October, compared to last year, with only 144,288 new vehicle registrations, according to the Society of Motor Manufacturers and Traders (SMMT). This is the second market drop this year.

Fleet sales, which have held relatively steady through most of the year, also fell in October, dropping 1.7%. The low-volume business segment was hit harder, experiencing a decline of 12.8%. Private purchases, continuing a downward trend for nearly two years, decreased by 11.8%. As a result, only about 38.8% of new cars sold in the first ten months of 2024 were bought by private consumers.

The overall market decline was largely driven by steep reductions in petrol and diesel vehicle sales, which fell by 14.2% and 20.5%. Hybrid and plug-in hybrid vehicles also experienced minor declines, with registrations down by 1.6% and 3.2%. The only exception to this decline was battery electric vehicles (BEVs), which saw pretty substantial growth. This was mainly due to new model releases and increased consumer choice. BEV registrations increased by 24.5%, holding a 20.7% market share in October.

The increase in BEV availability is certainly growing with UK consumers now having access to over 125 models. This is a 38% rise over the past ten months. Although BEVs typically come with higher upfront costs than traditional internal combustion engine (ICE) vehicles, an expanding range of options and substantial manufacturer discounts have made approximately 20% of BEV models more affordable than average petrol or diesel cars. Salary sacrifice programs and other incentives also help reduce costs.

Even though BEV sales increased, the overall market decline in October has led to an estimated £350 million loss in turnover. The targets set for BEV adoption across the country are quite a way off being met. There are now nearly 300,000 new BEVs on the road, this is still only 18.1% of the total market share. The target for this year is 22% increasing to 28% next year as part of the UK’s Vehicle Emissions Trading Scheme.

“Massive manufacturer investment in model choice and market support is helping make the UK the second largest EV market in Europe. That transition, however, must not perversely slow down the reduction of carbon emissions from road transport. Fleet renewal across the market remains the quickest way to decarbonise, so diminishing overall uptake is not good news for the economy, for investment or for the environment. EVs already work for many people and businesses, but to shift the entire market at the pace demanded requires significant intervention on incentives, infrastructure and regulation.”

Mike Hawes, SMMT Chief Executive

The recent Budget likely helped to some extent by extending fleet and business incentives for BEV purchases, but changes to the Vehicle Excise Duty and Company Car Tax have reduced incentives for low-carbon vehicle investments. This could add further delays to the timeline for reducing emissions in road transport.

To return to steady market growth, government support needs to match the manufacturers’ efforts. A review of current market conditions and regulations is likely needed to help the transition from ICE to zero-emission vehicles.

We use cookies to deliver the best possible experience whilst visiting our website. By clicking "Accept All", you consent to our use of cookies, or you can manage your preferences by clicking the link below. You can manage your preferences at any time from out Cookie Policy page.

Leave a Reply